Public Member Functions | |

| __construct (\Magento\Framework\Model\Context $context, \Magento\Framework\Registry $registry, \Magento\Framework\App\Config\ScopeConfigInterface $scopeConfig, Config $taxConfig, \Magento\Store\Model\StoreManagerInterface $storeManager, \Magento\Customer\Model\Session $customerSession, \Magento\Customer\Model\CustomerFactory $customerFactory, \Magento\Tax\Model\ResourceModel\TaxClass\CollectionFactory $classesFactory, \Magento\Tax\Model\ResourceModel\Calculation $resource, CustomerAccountManagement $customerAccountManagement, CustomerGroupManagement $customerGroupManagement, CustomerGroupRepository $customerGroupRepository, CustomerRepository $customerRepository, PriceCurrencyInterface $priceCurrency, SearchCriteriaBuilder $searchCriteriaBuilder, FilterBuilder $filterBuilder, TaxClassRepositoryInterface $taxClassRepository, \Magento\Framework\Data\Collection\AbstractDb $resourceCollection=null, array $data=[]) | |

| getDefaultCustomerTaxClass ($store=null) | |

| deleteByRuleId ($ruleId) | |

| getRates ($ruleId) | |

| getCustomerTaxClasses ($ruleId) | |

| getProductTaxClasses ($ruleId) | |

| getRate ($request) | |

| getStoreRate ($request, $store=null) | |

| getDefaultRateRequest ($store=null, $customerId=null) | |

| getRateRequest ( $shippingAddress=null, $billingAddress=null, $customerTaxClass=null, $store=null, $customerId=null) | |

| getAppliedRates ($request) | |

| reproduceProcess ($rates) | |

| calcTaxAmount ($price, $taxRate, $priceIncludeTax=false, $round=true) | |

| round ($price) | |

| getTaxRates ($billingAddress, $shippingAddress, $customerTaxClassId) | |

Public Member Functions inherited from AbstractModel Public Member Functions inherited from AbstractModel | |

| __construct (\Magento\Framework\Model\Context $context, \Magento\Framework\Registry $registry, \Magento\Framework\Model\ResourceModel\AbstractResource $resource=null, \Magento\Framework\Data\Collection\AbstractDb $resourceCollection=null, array $data=[]) | |

| __sleep () | |

| __wakeup () | |

| setIdFieldName ($name) | |

| getIdFieldName () | |

| getId () | |

| setId ($value) | |

| isDeleted ($isDeleted=null) | |

| hasDataChanges () | |

| setData ($key, $value=null) | |

| unsetData ($key=null) | |

| setDataChanges ($value) | |

| getOrigData ($key=null) | |

| setOrigData ($key=null, $data=null) | |

| dataHasChangedFor ($field) | |

| getResourceName () | |

| getResourceCollection () | |

| getCollection () | |

| load ($modelId, $field=null) | |

| beforeLoad ($identifier, $field=null) | |

| afterLoad () | |

| isSaveAllowed () | |

| setHasDataChanges ($flag) | |

| save () | |

| afterCommitCallback () | |

| isObjectNew ($flag=null) | |

| beforeSave () | |

| validateBeforeSave () | |

| getCacheTags () | |

| cleanModelCache () | |

| afterSave () | |

| delete () | |

| beforeDelete () | |

| afterDelete () | |

| afterDeleteCommit () | |

| getResource () | |

| getEntityId () | |

| setEntityId ($entityId) | |

| clearInstance () | |

| getStoredData () | |

| getEventPrefix () | |

Public Member Functions inherited from DataObject Public Member Functions inherited from DataObject | |

| __construct (array $data=[]) | |

| addData (array $arr) | |

| setData ($key, $value=null) | |

| unsetData ($key=null) | |

| getData ($key='', $index=null) | |

| getDataByPath ($path) | |

| getDataByKey ($key) | |

| setDataUsingMethod ($key, $args=[]) | |

| getDataUsingMethod ($key, $args=null) | |

| hasData ($key='') | |

| toArray (array $keys=[]) | |

| convertToArray (array $keys=[]) | |

| toXml (array $keys=[], $rootName='item', $addOpenTag=false, $addCdata=true) | |

| convertToXml (array $arrAttributes=[], $rootName='item', $addOpenTag=false, $addCdata=true) | |

| toJson (array $keys=[]) | |

| convertToJson (array $keys=[]) | |

| toString ($format='') | |

| __call ($method, $args) | |

| isEmpty () | |

| serialize ($keys=[], $valueSeparator='=', $fieldSeparator=' ', $quote='"') | |

| debug ($data=null, &$objects=[]) | |

| offsetSet ($offset, $value) | |

| offsetExists ($offset) | |

| offsetUnset ($offset) | |

| offsetGet ($offset) | |

Data Fields | |

| const | CALC_TAX_BEFORE_DISCOUNT_ON_EXCL = '0_0' |

| const | CALC_TAX_BEFORE_DISCOUNT_ON_INCL = '0_1' |

| const | CALC_TAX_AFTER_DISCOUNT_ON_EXCL = '1_0' |

| const | CALC_TAX_AFTER_DISCOUNT_ON_INCL = '1_1' |

| const | CALC_UNIT_BASE = 'UNIT_BASE_CALCULATION' |

| const | CALC_ROW_BASE = 'ROW_BASE_CALCULATION' |

| const | CALC_TOTAL_BASE = 'TOTAL_BASE_CALCULATION' |

Protected Member Functions | |

| _construct () | |

| _formCalculationProcess () | |

| _getRequestCacheKey ($request) | |

| getRateOriginRequest ($store=null) | |

| _isCrossBorderTradeEnabled ($store=null) | |

Protected Member Functions inherited from AbstractModel Protected Member Functions inherited from AbstractModel | |

| _construct () | |

| _init ($resourceModel) | |

| _setResourceModel ($resourceName, $collectionName=null) | |

| _getResource () | |

| _getEventData () | |

| _beforeLoad ($modelId, $field=null) | |

| _afterLoad () | |

| _hasModelChanged () | |

| _getValidatorBeforeSave () | |

| _createValidatorBeforeSave () | |

| _getValidationRulesBeforeSave () | |

| _clearReferences () | |

| _clearData () | |

Protected Member Functions inherited from DataObject Protected Member Functions inherited from DataObject | |

| _getData ($key) | |

| _underscore ($name) | |

Protected Attributes | |

| $_rates = [] | |

| $_ctc = [] | |

| $_ptc = [] | |

| $_rateCache = [] | |

| $_rateCalculationProcess = [] | |

| $_customer | |

| $_defaultCustomerTaxClass | |

| $_scopeConfig | |

| $_storeManager | |

| $_customerSession | |

| $_customerFactory | |

| $_classesFactory | |

| $_config | |

| $customerAccountManagement | |

| $customerGroupManagement | |

| $customerGroupRepository | |

| $customerRepository | |

| $priceCurrency | |

| $filterBuilder | |

| $searchCriteriaBuilder | |

| $taxClassRepository | |

Protected Attributes inherited from AbstractModel Protected Attributes inherited from AbstractModel | |

| $_eventPrefix = 'core_abstract' | |

| $_eventObject = 'object' | |

| $_idFieldName = 'id' | |

| $_hasDataChanges = false | |

| $_origData | |

| $_isDeleted = false | |

| $_resource | |

| $_resourceCollection | |

| $_resourceName | |

| $_collectionName | |

| $_cacheTag = false | |

| $_dataSaveAllowed = true | |

| $_isObjectNew = null | |

| $_validatorBeforeSave = null | |

| $_eventManager | |

| $_cacheManager | |

| $_registry | |

| $_logger | |

| $_appState | |

| $_actionValidator | |

| $storedData = [] | |

Protected Attributes inherited from DataObject Protected Attributes inherited from DataObject | |

| $_data = [] | |

Additional Inherited Members | |

Static Protected Attributes inherited from DataObject Static Protected Attributes inherited from DataObject | |

| static | $_underscoreCache = [] |

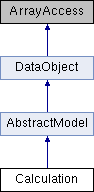

Detailed Description

Tax Calculation Model @SuppressWarnings(PHPMD.TooManyFields) @SuppressWarnings(PHPMD.CouplingBetweenObjects)

Definition at line 27 of file Calculation.php.

Constructor & Destructor Documentation

◆ __construct()

| __construct | ( | \Magento\Framework\Model\Context | $context, |

| \Magento\Framework\Registry | $registry, | ||

| \Magento\Framework\App\Config\ScopeConfigInterface | $scopeConfig, | ||

| Config | $taxConfig, | ||

| \Magento\Store\Model\StoreManagerInterface | $storeManager, | ||

| \Magento\Customer\Model\Session | $customerSession, | ||

| \Magento\Customer\Model\CustomerFactory | $customerFactory, | ||

| \Magento\Tax\Model\ResourceModel\TaxClass\CollectionFactory | $classesFactory, | ||

| \Magento\Tax\Model\ResourceModel\Calculation | $resource, | ||

| CustomerAccountManagement | $customerAccountManagement, | ||

| CustomerGroupManagement | $customerGroupManagement, | ||

| CustomerGroupRepository | $customerGroupRepository, | ||

| CustomerRepository | $customerRepository, | ||

| PriceCurrencyInterface | $priceCurrency, | ||

| SearchCriteriaBuilder | $searchCriteriaBuilder, | ||

| FilterBuilder | $filterBuilder, | ||

| TaxClassRepositoryInterface | $taxClassRepository, | ||

| \Magento\Framework\Data\Collection\AbstractDb | $resourceCollection = null, |

||

| array | $data = [] |

||

| ) |

- Parameters

-

\Magento\Framework\Model\Context $context \Magento\Framework\Registry $registry \Magento\Framework\App\Config\ScopeConfigInterface $scopeConfig Config $taxConfig \Magento\Store\Model\StoreManagerInterface $storeManager \Magento\Customer\Model\Session $customerSession \Magento\Customer\Model\CustomerFactory $customerFactory \Magento\Tax\Model\ResourceModel\TaxClass\CollectionFactory $classesFactory \Magento\Tax\Model\ResourceModel\Calculation $resource CustomerAccountManagement $customerAccountManagement CustomerGroupManagement $customerGroupManagement CustomerGroupRepository $customerGroupRepository CustomerRepository $customerRepository PriceCurrencyInterface $priceCurrency SearchCriteriaBuilder $searchCriteriaBuilder FilterBuilder $filterBuilder TaxClassRepositoryInterface $taxClassRepository \Magento\Framework\Data\Collection\AbstractDb $resourceCollection array $data @SuppressWarnings(PHPMD.ExcessiveParameterList)

Definition at line 213 of file Calculation.php.

Member Function Documentation

◆ _construct()

|

protected |

◆ _formCalculationProcess()

|

protected |

◆ _getRequestCacheKey()

|

protected |

Get cache key value for specific tax rate request

- Parameters

-

\Magento\Framework\DataObject $request

- Returns

- string

Definition at line 387 of file Calculation.php.

◆ _isCrossBorderTradeEnabled()

|

protected |

Return whether cross border trade is enabled or not

- Parameters

-

null | int | string | Store $store

- Returns

- bool

Definition at line 477 of file Calculation.php.

◆ calcTaxAmount()

| calcTaxAmount | ( | $price, | |

| $taxRate, | |||

$priceIncludeTax = false, |

|||

$round = true |

|||

| ) |

Calculate rated tax amount based on price and tax rate. If you are using price including tax $priceIncludeTax should be true.

- Parameters

-

float $price float $taxRate boolean $priceIncludeTax boolean $round

- Returns

- float

Definition at line 661 of file Calculation.php.

◆ deleteByRuleId()

| deleteByRuleId | ( | $ruleId | ) |

Delete calculation settings by rule id

- Parameters

-

int $ruleId

- Returns

- $this

Definition at line 281 of file Calculation.php.

◆ getAppliedRates()

| getAppliedRates | ( | $request | ) |

Get information about tax rates applied to request

- Parameters

-

\Magento\Framework\DataObject $request

- Returns

- array

Definition at line 627 of file Calculation.php.

◆ getCustomerTaxClasses()

| getCustomerTaxClasses | ( | $ruleId | ) |

Get allowed customer tax classes by rule id

- Parameters

-

int $ruleId

- Returns

- array

Definition at line 307 of file Calculation.php.

◆ getDefaultCustomerTaxClass()

| getDefaultCustomerTaxClass | ( | $store = null | ) |

Fetch default customer tax class

- Parameters

-

null | Store | string | int $store

- Returns

- int

Definition at line 265 of file Calculation.php.

◆ getDefaultRateRequest()

| getDefaultRateRequest | ( | $store = null, |

|

$customerId = null |

|||

| ) |

Return the default rate request. It can be either based on store address or customer address

- Parameters

-

null | int | string | Store $store int $customerId

- Returns

- \Magento\Framework\DataObject

Definition at line 461 of file Calculation.php.

◆ getProductTaxClasses()

| getProductTaxClasses | ( | $ruleId | ) |

Get allowed product tax classes by rule id

- Parameters

-

int $ruleId

- Returns

- array

Definition at line 321 of file Calculation.php.

◆ getRate()

| getRate | ( | $request | ) |

Get calculation tax rate by specific request

- Parameters

-

\Magento\Framework\DataObject $request

- Returns

- float

Definition at line 356 of file Calculation.php.

◆ getRateOriginRequest()

|

protected |

Get request object for getting tax rate based on store shipping original address

- Parameters

-

null | string | bool | int | Store $store

- Returns

- \Magento\Framework\DataObject

Definition at line 425 of file Calculation.php.

◆ getRateRequest()

| getRateRequest | ( | $shippingAddress = null, |

|

$billingAddress = null, |

|||

$customerTaxClass = null, |

|||

$store = null, |

|||

$customerId = null |

|||

| ) |

Get request object with information necessary for getting tax rate

Request object contain: country_id (->getCountryId()) region_id (->getRegionId()) postcode (->getPostcode()) customer_class_id (->getCustomerClassId()) store (->getStore())

- Parameters

-

null | bool | \Magento\Framework\DataObject | CustomerAddress $shippingAddress null | bool | \Magento\Framework\DataObject | CustomerAddress $billingAddress null | int $customerTaxClass null | int | \Magento\Store\Model\Store $store int $customerId

- Returns

- \Magento\Framework\DataObject @SuppressWarnings(PHPMD.CyclomaticComplexity) @SuppressWarnings(PHPMD.NPathComplexity) @SuppressWarnings(PHPMD.ExcessiveMethodLength)

Definition at line 502 of file Calculation.php.

◆ getRates()

| getRates | ( | $ruleId | ) |

Get calculation rates by rule id

- Parameters

-

int $ruleId

- Returns

- array

Definition at line 293 of file Calculation.php.

◆ getStoreRate()

| getStoreRate | ( | $request, | |

$store = null |

|||

| ) |

Get tax rate based on store shipping origin address settings This rate can be used for conversion store price including tax to store price excluding tax

- Parameters

-

\Magento\Framework\DataObject $request null | string | bool | int | Store $store

- Returns

- float

Definition at line 413 of file Calculation.php.

◆ getTaxRates()

| getTaxRates | ( | $billingAddress, | |

| $shippingAddress, | |||

| $customerTaxClassId | |||

| ) |

- Parameters

-

array $billingAddress array $shippingAddress int $customerTaxClassId

- Returns

- array

Definition at line 695 of file Calculation.php.

◆ reproduceProcess()

| reproduceProcess | ( | $rates | ) |

Gets the calculation process

- Parameters

-

array $rates

- Returns

- array

Definition at line 646 of file Calculation.php.

◆ round()

| round | ( | $price | ) |

Round tax amount

- Parameters

-

float $price

- Returns

- float

Definition at line 684 of file Calculation.php.

Field Documentation

◆ $_classesFactory

|

protected |

Definition at line 136 of file Calculation.php.

◆ $_config

|

protected |

Definition at line 143 of file Calculation.php.

◆ $_ctc

|

protected |

Definition at line 76 of file Calculation.php.

◆ $_customer

|

protected |

Definition at line 104 of file Calculation.php.

◆ $_customerFactory

|

protected |

Definition at line 131 of file Calculation.php.

◆ $_customerSession

|

protected |

Definition at line 126 of file Calculation.php.

◆ $_defaultCustomerTaxClass

|

protected |

Definition at line 109 of file Calculation.php.

◆ $_ptc

|

protected |

Definition at line 83 of file Calculation.php.

◆ $_rateCache

|

protected |

Definition at line 90 of file Calculation.php.

◆ $_rateCalculationProcess

|

protected |

Definition at line 97 of file Calculation.php.

◆ $_rates

|

protected |

Definition at line 69 of file Calculation.php.

◆ $_scopeConfig

|

protected |

Definition at line 116 of file Calculation.php.

◆ $_storeManager

|

protected |

Definition at line 121 of file Calculation.php.

◆ $customerAccountManagement

|

protected |

Definition at line 148 of file Calculation.php.

◆ $customerGroupManagement

|

protected |

Definition at line 153 of file Calculation.php.

◆ $customerGroupRepository

|

protected |

Definition at line 158 of file Calculation.php.

◆ $customerRepository

|

protected |

Definition at line 163 of file Calculation.php.

◆ $filterBuilder

|

protected |

Definition at line 175 of file Calculation.php.

◆ $priceCurrency

|

protected |

Definition at line 168 of file Calculation.php.

◆ $searchCriteriaBuilder

|

protected |

Definition at line 182 of file Calculation.php.

◆ $taxClassRepository

|

protected |

Definition at line 189 of file Calculation.php.

◆ CALC_ROW_BASE

| const CALC_ROW_BASE = 'ROW_BASE_CALCULATION' |

Identifier constant for row based calculation

Definition at line 57 of file Calculation.php.

◆ CALC_TAX_AFTER_DISCOUNT_ON_EXCL

| const CALC_TAX_AFTER_DISCOUNT_ON_EXCL = '1_0' |

Identifier constant for Tax calculation after discount excluding TAX

Definition at line 42 of file Calculation.php.

◆ CALC_TAX_AFTER_DISCOUNT_ON_INCL

| const CALC_TAX_AFTER_DISCOUNT_ON_INCL = '1_1' |

Identifier constant for Tax calculation after discount including TAX

Definition at line 47 of file Calculation.php.

◆ CALC_TAX_BEFORE_DISCOUNT_ON_EXCL

| const CALC_TAX_BEFORE_DISCOUNT_ON_EXCL = '0_0' |

Identifier constant for Tax calculation before discount excluding TAX

Definition at line 32 of file Calculation.php.

◆ CALC_TAX_BEFORE_DISCOUNT_ON_INCL

| const CALC_TAX_BEFORE_DISCOUNT_ON_INCL = '0_1' |

Identifier constant for Tax calculation before discount including TAX

Definition at line 37 of file Calculation.php.

◆ CALC_TOTAL_BASE

| const CALC_TOTAL_BASE = 'TOTAL_BASE_CALCULATION' |

Identifier constant for total based calculation

Definition at line 62 of file Calculation.php.

◆ CALC_UNIT_BASE

| const CALC_UNIT_BASE = 'UNIT_BASE_CALCULATION' |

Identifier constant for unit based calculation

Definition at line 52 of file Calculation.php.

The documentation for this class was generated from the following file:

- vendor/magento/module-tax/Model/Calculation.php